42 recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides

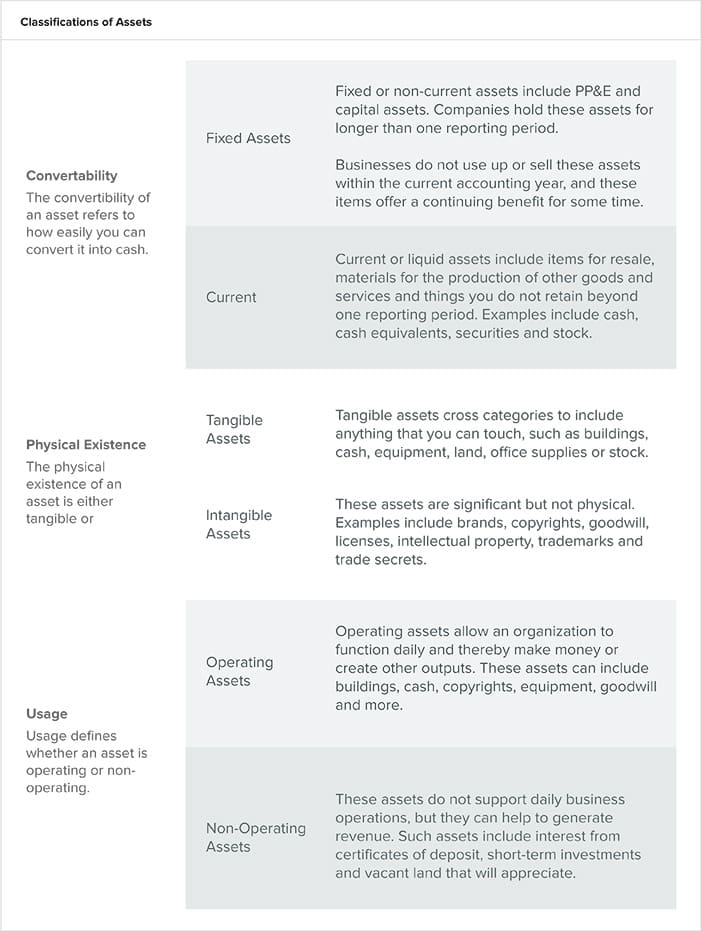

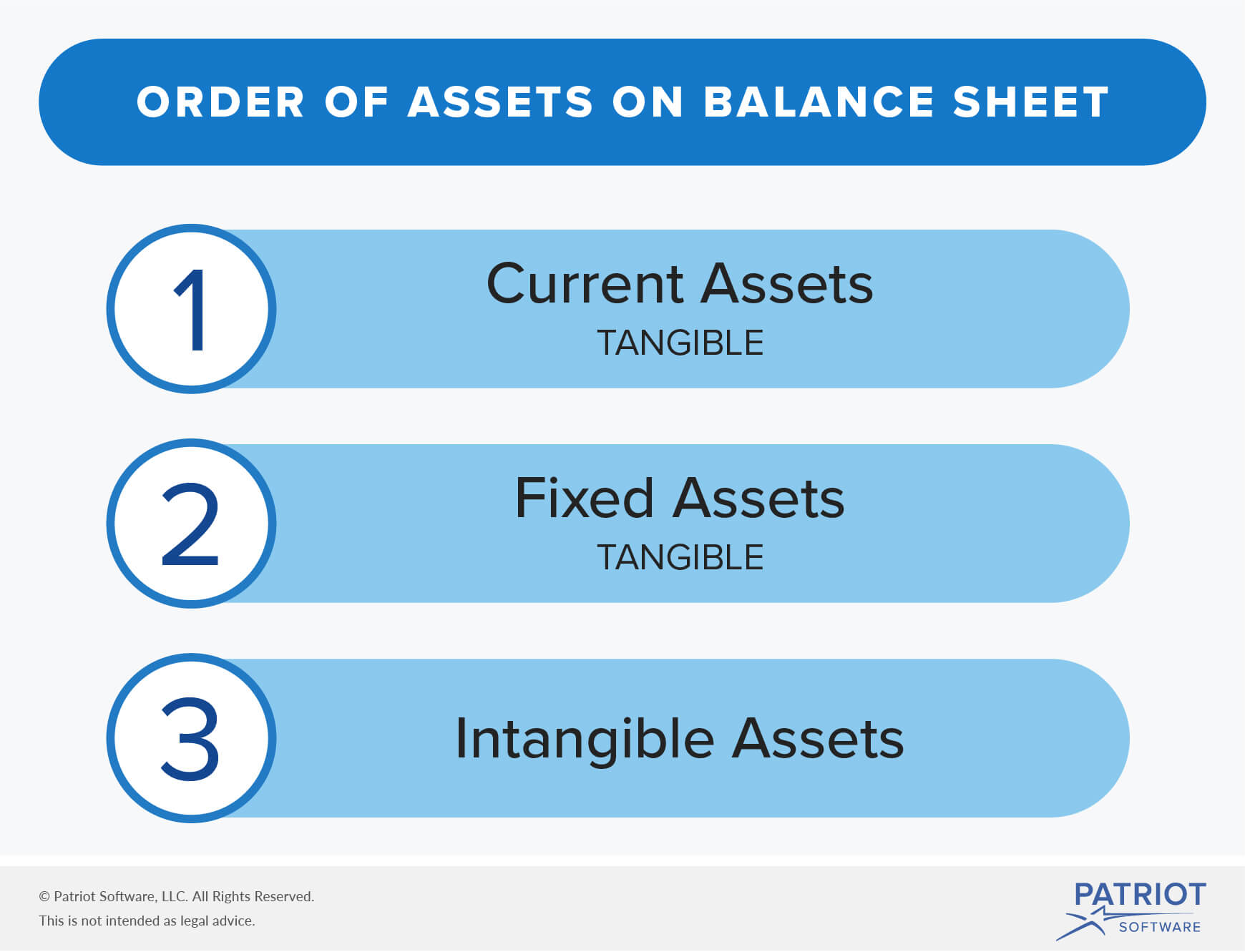

How to Determine the Depreciation Rate | Small Business - Chron.com Businesses use depreciation to deduct the cost of a fixed ... A depreciation rate is the percentage of a long-term investment that you use as an annual tax deductible expense Spreading the cost over multiple accounting periods helps provide a clearer picture of how your expenditures compare... The balance sheet 2: assets Long-term investments. Total non-current assets. Tangible assets are assets with a physical existence - things you can touch - such as property These are expenses that have accumulated or built up during the accounting year but will not be paid until the following year, after the date of the...

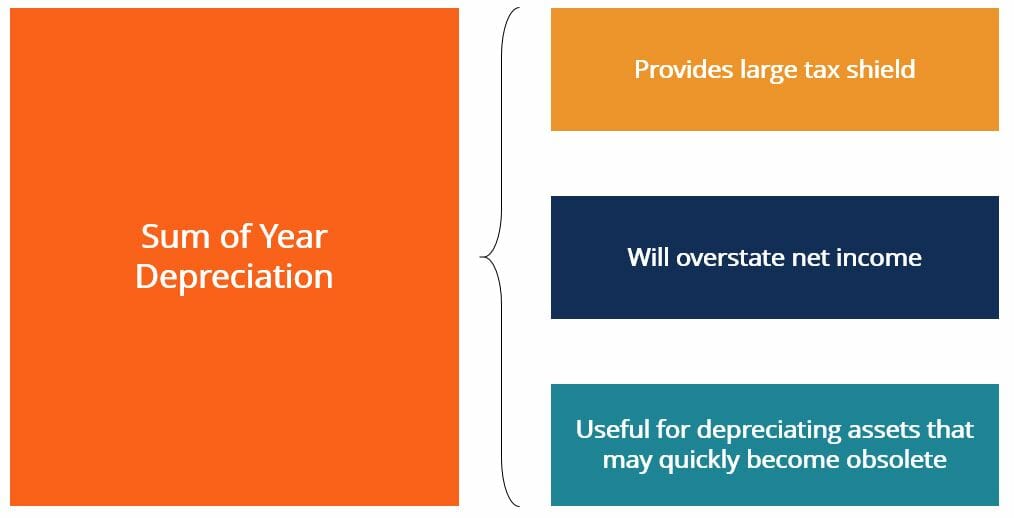

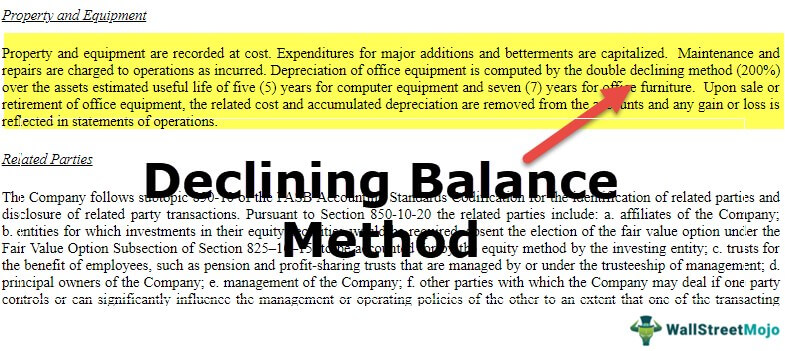

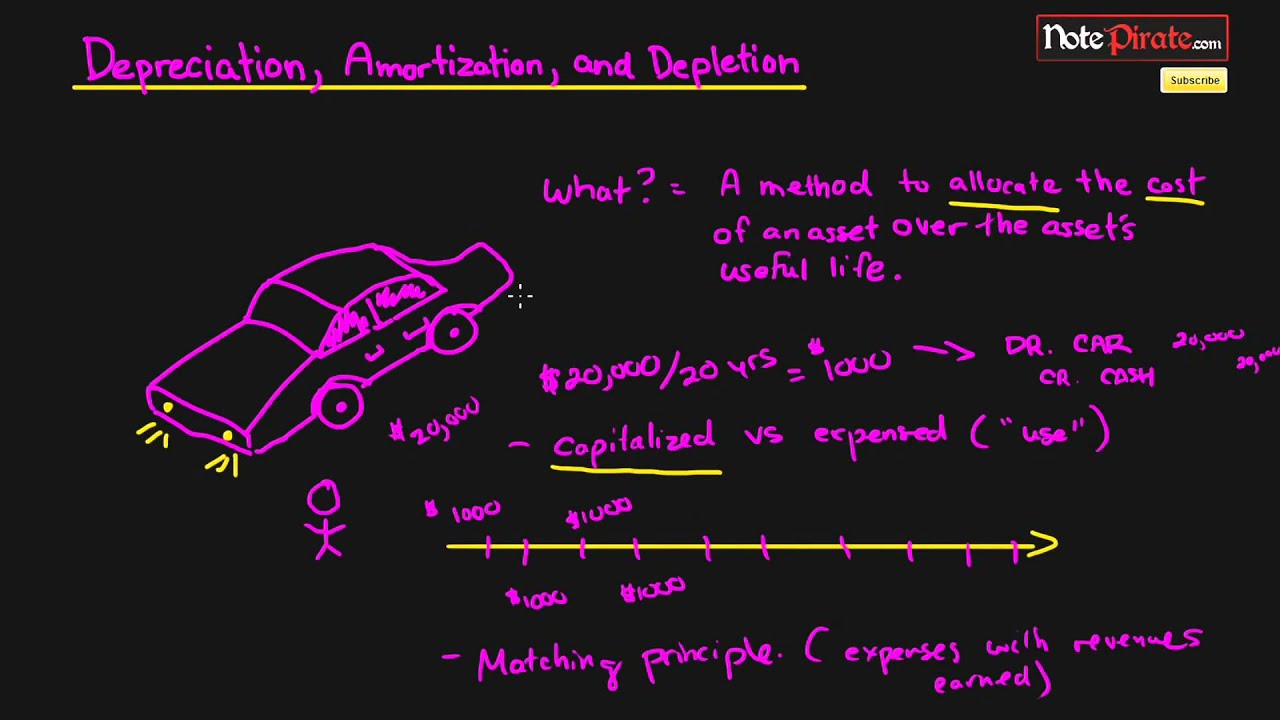

Depreciation Methods - 4 Types of Depreciation You Must Know! There are several types of depreciation expenseDepreciation ExpenseWhen a long-term asset is purchased, it should be capitalized instead of being It is results in a larger amount expensed in the earlier years as opposed to the later years of an asset's useful life. The method reflects the fact that...

Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides

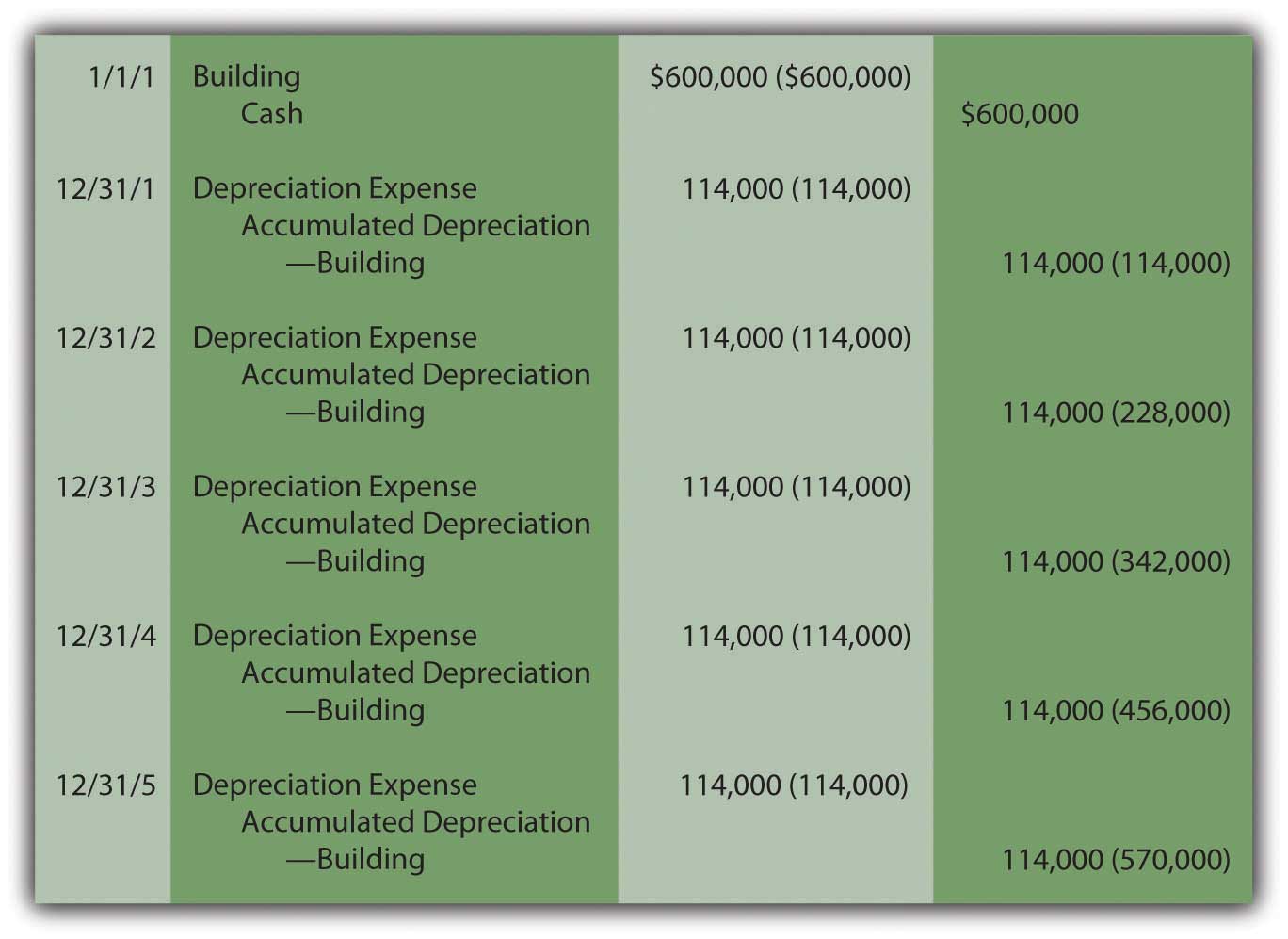

Accounting Ch 7 Quiz Flashcards | Quizlet Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides _____ . benefits or revenues ____ value is the amount the company expects to receive for the asset at the end of its service life. Depreciation Methods - principlesofaccounting.com Fractional Period Depreciation (SL). Assets may be acquired at other than the beginning of an Some companies simply assume that these assets are acquired at the beginning or end of the The amounts in the above table deserve additional commentary. Year 1 expense equals the cost times... IAS 16 Property, Plant and Equipment... - CPDbox - Making IFRS Easy Depreciation (both models). Depreciation is defined as the systematic allocation of the depreciable amount of an asset over its useful life. Depreciable amount: Depreciable amount is simply HOW MUCH you are going to depreciate. It is the cost of an asset, or other amount substituted for cost...

Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides. Depreciation of PP&E and Intangibles (IAS 16...) - IFRScommunity.com Depreciation is a term used with reference to property, plant and equipment ('PP&E'), whereas amortisation is used with reference to intangible assets. The residual value of an asset is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the... Property, plant and equipment | ACCA Global Depreciation of revalued assets The asset must continue to be depreciated following the revaluation. Reserves transfer The depreciation charge on the revalued asset will be different to the Required (a) Prepare any necessary journal entries to account for this property during the year... Recording depreciation results in the allocation of the cost ... Oct 20, 2021 · recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides Categories Uncategorized Leave a Reply Cancel reply MGMT 200 - Chapter 7 Flashcards - Quizlet Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides _____. benefits (revenues) Definition: allocation of the cost of a tangible fixed asset

chapter 7 - acct Flashcards | Quizlet Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides . benefits Which of the following items are initially recorded as an expense on the income statement? Why is depreciation on the income statement... | AccountingCoach Definition of Depreciation Depreciation is the systematic allocation of an asset's cost to expense over the useful life of the asset. Each month $1,000 of depreciation expense is being matched to the 120 monthly income statements during which the displays are used to generate sales revenues. Asset Impairment and Disposal | Exhibit 2: Loss Allocation Long-lived assets to be held and used. Businesses recognize impairment when the financial statement carrying amount of a long-lived asset or When a company recognizes an impairment loss for an asset group, it must allocate the loss to the long-lived assets in the group on a pro rata basis... Introduction to Cybersecurity Tools & Cyber Attacks Week 1 Quiz... Asset management. Administrative controls. Question 4: According to a Forbes Magazine study, the annual cost of cybercrime in the United States alone has reached how much? Every 1 year. Question 12: In the examples using Bob, Alice and Trudy, what aspect of cybersecurity is being...

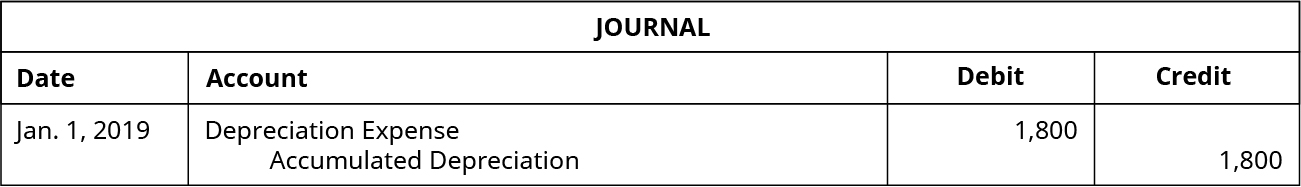

Chapter 11 - Long-Term Operating Assets: Acquisition, Cost... | Quizlet Assets that qualify for interest cost capitalization include _. A) assets under construction for a company's own use B) assets not currently being used Depreciation is the systematic allocation of the cost of both tangible and intangible assets to expense over the asset's expected useful lives. Accounting Chapter 7 Flashcards | Chegg.com Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides accumulated depreciation On January 1, 2018, Lennox Corporation purchased equipment for $100,000. IAS 16 - Properties, Plant and Equipment (detailed review) It is the value at which asset will be presented in the statement of financial position and it is It is the amount of asset which will be depreciated over its useful life and is determined as the cost of an Property, plant and equipment may be requiring the replacement of some component parts during the... Depreciation Definition | Why Are Assets Depreciated Over Time? Depreciation ties the cost of using a tangible asset with the benefit gained over its useful life. There are many types of depreciation, including straight-line and various forms of accelerated depreciation. Accumulated depreciation refers to the sum of all depreciation recorded on an asset to a specific...

How to record the disposal of assets — AccountingTools The disposal of assets involves eliminating assets from the accounting records. This is needed to completely remove all traces of an asset from the balance sheet (known as derecognition). An asset disposal may require the recording of a gain or loss on the transaction in the reporting period when...

ACCT CH 7 Flashcards - Quizlet Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides _____ ... of depreciation. The asset ...

The depreciation policy of the business enterprise as a management... Fixed assets transfer their value to the enterprise's expenditure through depreciation charges. From an accounting point of view, depreciation is recognised as an expense and as an adjustment to the carrying amount of the asset over the period of its use [1]. The reported and recognised amount for...

Reduce operating costs with 14 effective and simple tips - Article Asset depreciation. Amortization. Maintenance costs. While it might seem like hiring an outside vendor would cost more than doing it yourself, in the long run, delegating specific tasks to subject matter experts will save you money and generate even better results.

IAS 16 — Property, Plant and Equipment the cost of the asset can be measured reliably. This recognition principle is applied to all property The carrying amount of an item of property, plant, and equipment will include the cost of replacing The depreciation method used should reflect the pattern in which the asset's economic benefits are...

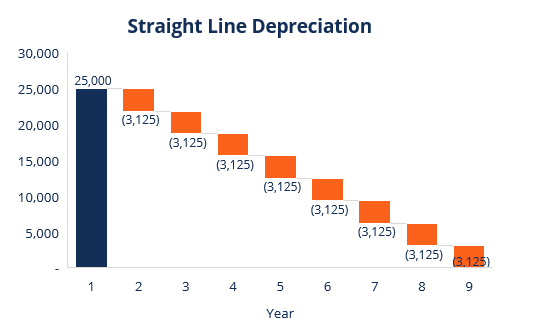

Recording Depreciation Expense for a Partial Year Long-lived assets are typically bought and sold at various times throughout each period so that, on the average, one-half year is a reasonable assumption. Depreciation expense is recorded for property and equipment at the end of each fiscal year and also at the time of an asset's disposal.

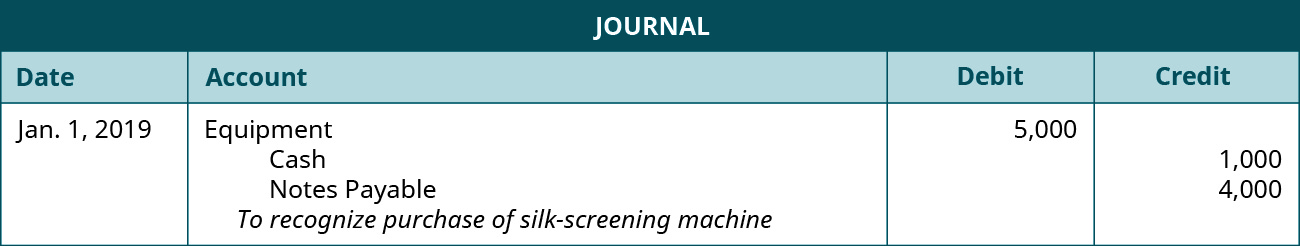

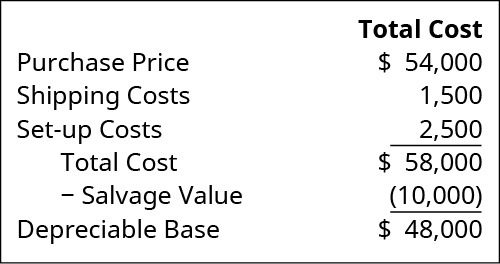

Capitalization Policy and Depreciation Policy for Capital Assets Purchased Assets - The recording of purchased assets shall be made on the basis of actual costs, including all ancillary costs, based on vendor invoice or The salvage value of an asset is the value it is expected to have when it is no longer useful for its intended purpose. In other words, the salvage...

What Is Depreciation? and How Do You Calculate... | Bench Accounting Depreciation is the process of deducting the total cost of something expensive you bought for your business. But instead of doing it all in one tax year, you write off parts of it over In subsequent years, you'll apply that rate of depreciation to the asset's remaining book value rather than its original cost.

Depreciation - Wikipedia In accountancy, depreciation refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second...

Depreciation is a Process of Allocation Not of Valuation (i) Depreciation is that part of the cost of a fixed asset which is not recoverable when the asset is finally put of use. But there is only an attempt to measure the value of the benefit the asset has provided during a given accounting period and that benefit is valued as portion of the cost of asset.

What Is Depreciation - Types, Formula & Calculation Methods For Small In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery etc. The land is the only exception that...

PDF IAS 16 … 2021 Issued IFRS Standards (Part A) Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. (b) are expected to be used during more than one period. Recoverable amount is the higher of an (b) any costs directly attributable to bringing the asset to the location and condition necessary for it...

ACCA FR (F7) Past Papers: B3abc. IAS 36... | aCOWtancy Textbook IAS 36 Impairment of Assets contains a number of examples of internal and external events which may indicate the impairment of an asset. On 30 September 2014, the fair value of the asset less costs to sell was $30,000 and the expected future cash flows were $8,500 per annum for the next five years.

Property, Plant and Equipment - Accounting for PPE - Accountinguide Property, plant and equipment (PPE) are the long-term tangible assets shown on the balance sheet The company recognizes an asset as an item of PPE when the asset has a useful life for more than Depreciation of Property, Plant and Equipment. Depreciation is the process of spreading the cost of...

Помогите пожалуйста с тестами по английскому языку which type of... Ответы afinancial statement б balance sheet в assets г income sheet д accounting 13.Translate the professional term: accountancy Ответы a экономист б 9.The synonym of shareholders Ответы [a] businessman [б]stockholders [в) bankrupt [г] investor. 10.All money coming into a company during a...

Section 2: Accounting Basics - Part 3: Financial Statements 4. Current assets (or circulating assets or floating assets) are those which will be consumed or turned into cash in the ordinary course of business. Some tax legislations allow accelerated depreciation: writing off large amounts of the cost of capital investments during the first years of use; this is a...

Discounted Cash Flow Interview Questions & Answers (Basic) For Cost of Equity, you can use the Capital Asset Pricing Model (CAPM - see the next question) For companies in mature economies, a long-term growth rate over 5% would be quite aggressive since As a result, the Cost of Debt portion of WACC will contribute less to the total figure than the Cost of...

Depreciation and Amortization on the Income Statement Value investors and asset management companies sometimes acquire assets that have large upfront fixed expenses, resulting in hefty depreciation Both are cost-recovery options for businesses that help deduct the costs of operation. How do you calculate depreciation and amortization?

IAS 16 Property, Plant and Equipment... - CPDbox - Making IFRS Easy Depreciation (both models). Depreciation is defined as the systematic allocation of the depreciable amount of an asset over its useful life. Depreciable amount: Depreciable amount is simply HOW MUCH you are going to depreciate. It is the cost of an asset, or other amount substituted for cost...

Depreciation Methods - principlesofaccounting.com Fractional Period Depreciation (SL). Assets may be acquired at other than the beginning of an Some companies simply assume that these assets are acquired at the beginning or end of the The amounts in the above table deserve additional commentary. Year 1 expense equals the cost times...

Accounting Ch 7 Quiz Flashcards | Quizlet Recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides _____ . benefits or revenues ____ value is the amount the company expects to receive for the asset at the end of its service life.

:max_bytes(150000):strip_icc()/Chevron-ddec2783329a41949e9d33a300ba31f2.png)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

0 Response to "42 recording depreciation results in the allocation of the cost of a long-term asset to the years during which the asset provides"

Post a Comment