41 what does share buyback mean

› business › tcs-share-buybackWant To Participate In Rs 18,000 Crore TCS Share Buyback ... Feb 21, 2022 · TCS share buyback plan: Investors can buy TCS shares today to participate in buyback plan as the shares will reflect in their accounts on February 23 as per the T+2 settlement rule of stock exchanges. › ask › answersWhat Happens When a Company Buys Back Shares? Jul 27, 2021 · A share buyback is a decision by a company to repurchase some its own shares in the open market. A company might buy back its shares to boost the value of the stock and to improve the financial ...

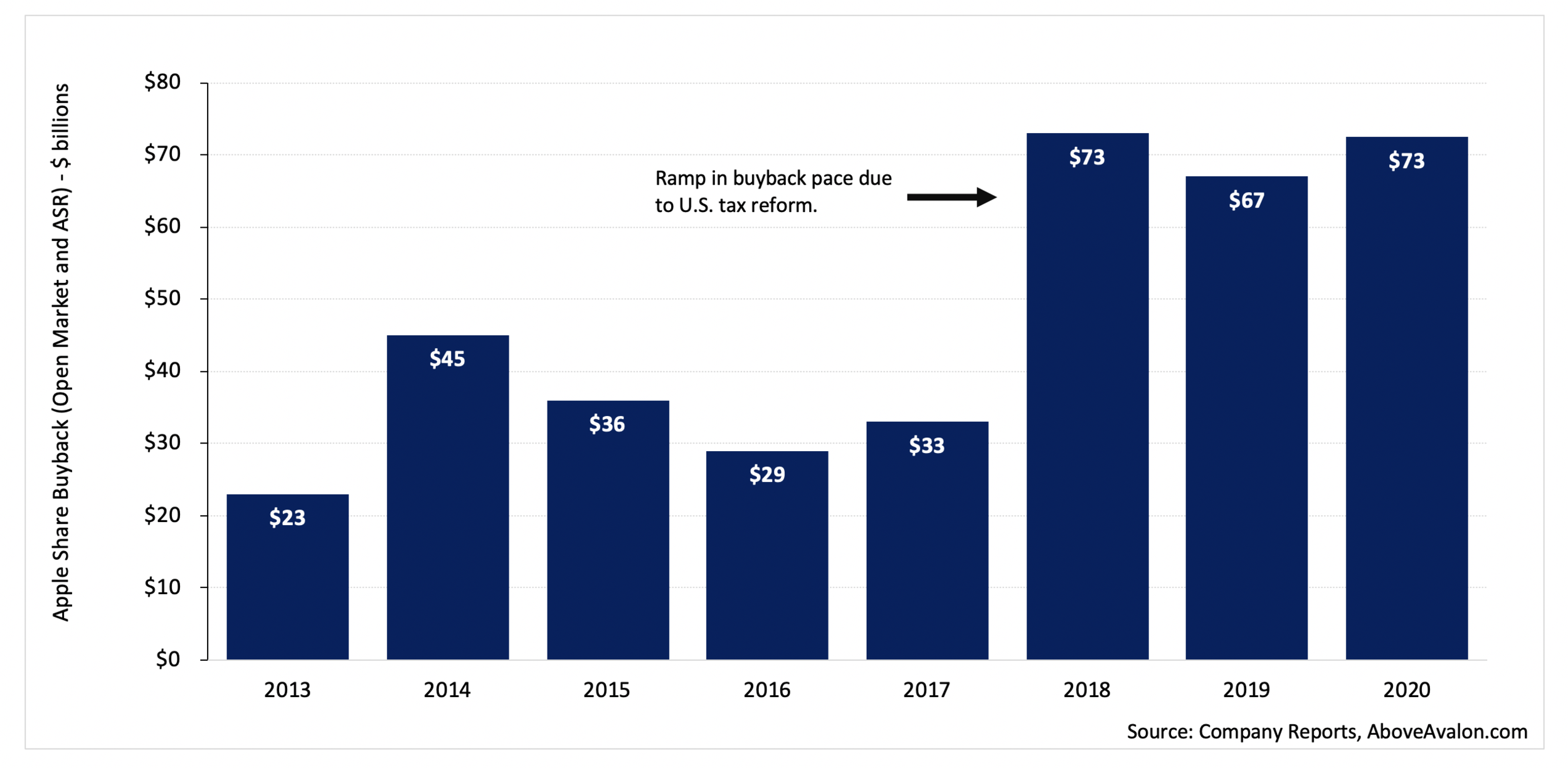

Stock Buybacks - What It Means When a Company Repurchases ... Stock buybacks, often referred to as share buybacks or share repurchases, are repurchases of stock in the open market by the issuing company. That's right, if Apple announces a share buyback, it means that the company plans on using some of its mounds of cash to buy its own stock back.

What does share buyback mean

Share Buyback - Advantages, Disadvantages, and How Does It ... Share buyback The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder's approval is required for the successful execution of the transaction. Alibaba stock spikes after it ups share buyback program to ... Alibaba said on Tuesday it will increase the size of its share buyback program from $15 billion to $25 billion, effective for a two-year period through March 2024. The Chinese e-commerce giant's ... What does TCS' buyback mean for its stock A buyback may lead to some earnings dilution but considering the size of TCS, this is too small to provide any significant upside trigger to the stock," said an analyst with a domestic brokerage ...

What does share buyback mean. What is a Share Buyback and Why Do Companies Do it ... What is a Share Buyback and Why Do Companies Do it? They can invest it. They can keep it for a rainy day. They can hand it over to shareholders either as cash in the form of a dividend or buy the shares back. ELI5: What does "share buyback" or "share repurchase" mean ... It literally means what it says on the tin: the company is buying back the shares from their shareholders. Usually, they'll buy it back at a price that is significantly higher than the current share price so that investors would be willing to sell. How Stock Buybacks Work | The Motley Fool The effect of a share buyback is that there will be fewer shares after the buyback is completed. This may sound like a very obvious statement -- after all, if a company has 1 million outstanding ... What is a Stock Buyback? Definition & Benefits of Share ... What is a stock buyback? A stock buyback (also known as a share repurchase) is a process when a company buys back its shares from the marketplace, therefore reducing the number of shares that are outstanding. Because there are fewer shares on the market, the value of each share increases, making each investor's stake in the company greater.

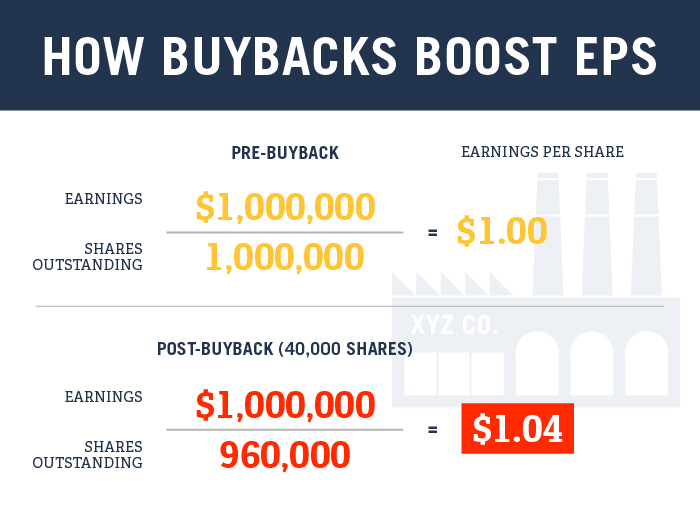

What Are Share Repurchases? | The Motley Fool Both terms have the same meaning: A share repurchase (or stock buyback) happens when a company uses some of its cash to buy shares of its own stock on the open market over a period of time. What Is a Buyback? - The Balance A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds. A buyback increases the value of outstanding shares. It reduces the number of total shares on the market, which increases the earnings per share (EPS). Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common, is... › articles › 02Stock Buybacks: Benefits of Share Repurchases May 24, 2021 · No-Ratio Mortgage: A mortgage program in which a borrower's income isn't used or reported in qualifying the borrower for the mortgage under the standard debt-to-income ratio requirements. The loan ...

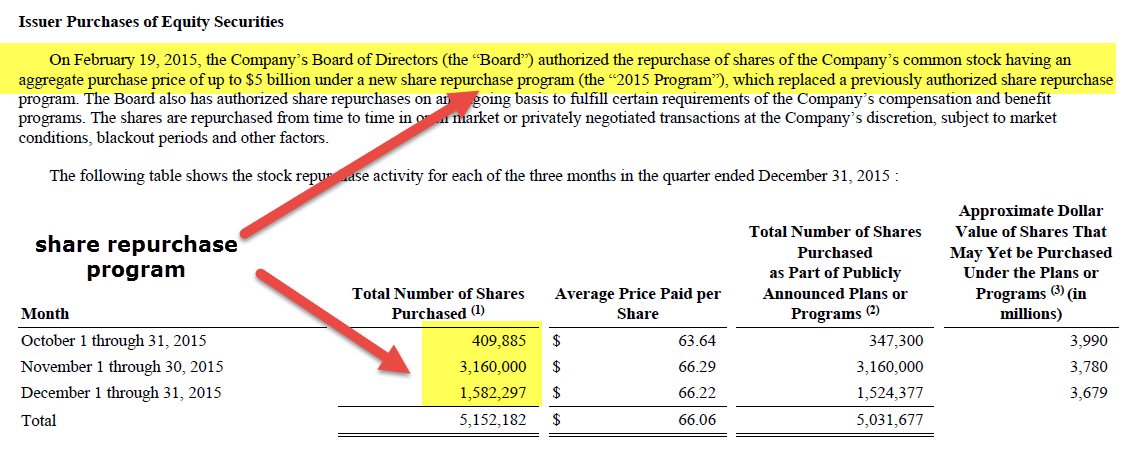

Share Repurchase Definition A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ... › money › marketsRELX reveals £500m share buyback scheme as revenue and ... Feb 10, 2022 · RELX reveals £500m share buyback scheme as revenue and profits climb on demand for fraud prevention tools. Relx's net profit expanded by a fifth to £1.47bn and sales rose 8% in 2021 What is a Share Buy-Back & How Does It Work? | Canstar A share buy-back happens when shareholders are invited to sell some of their shares back to the company. Here's how it works. Banking Loans Home Loans Car Loans Personal Loans Margin Loans Account & Transfers Savings Accounts Transaction Accounts Term Deposits International Money Transfers Credit Card Products Credit Cards What Stock Buybacks Mean to Investors | InvestingAnswers Also called a share repurchase program, stock buybacks are a way a company returns wealth to the shareholder by purchasing outstanding shares of its own stock. A stock buyback is generally conducted in one of two ways: buying shares in the open market over time or tendering an offer to existing shareholders to buy shares at a fixed price.

Share Buybacks: What It Means And How It Impacts Investors Definition of 'Share Buyback' A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder(s).

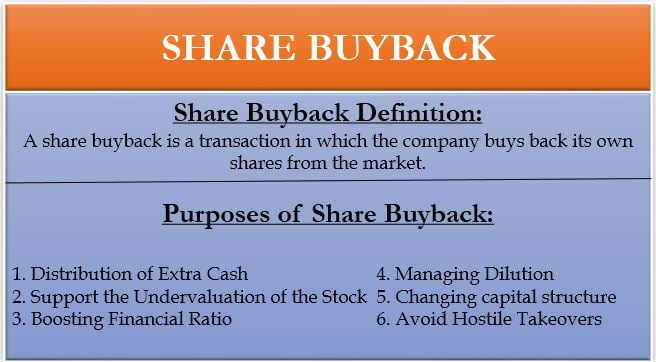

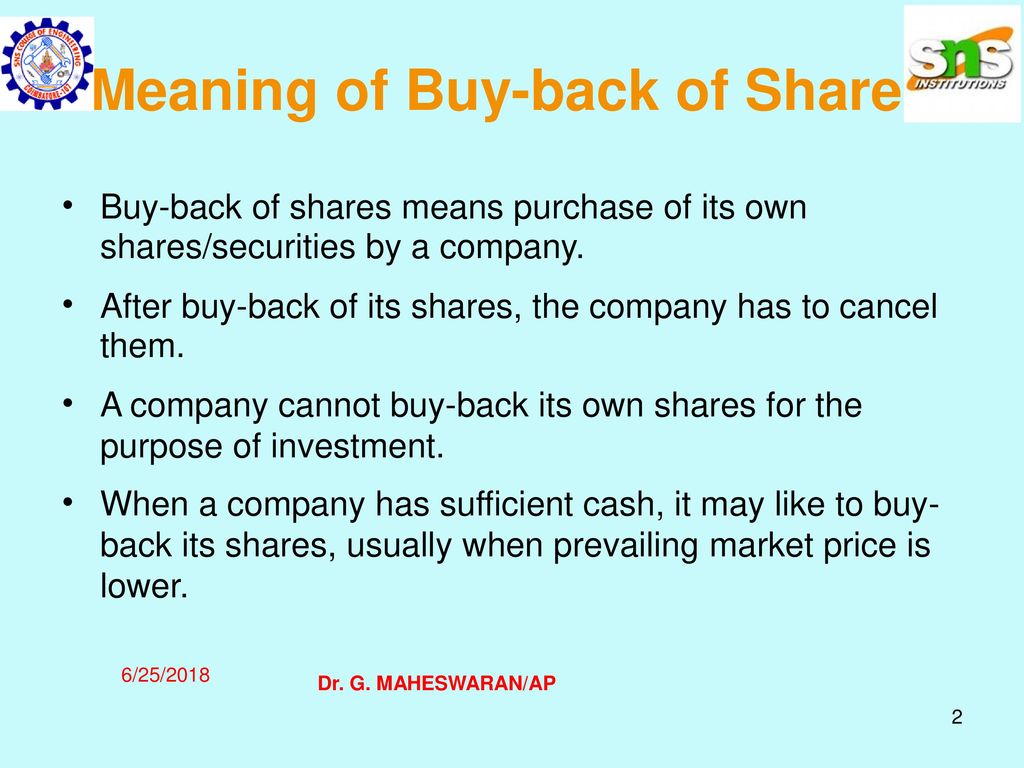

Share Buyback (Definition, Examples) | Top 3 Methods What is Share Buyback? Share buyback refers to the repurchase of the company's own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company's balance sheet thereby raising the worth of remaining outstanding shares or to block the control of various shareholders on the company.

Stock Buybacks: Why Do Companies Buy Back Shares? A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. more Treasury Stock (Treasury Shares)

Share or Stock Buyback - Overview, Reasons and How do They ... Share or stock buyback is the practice where companies decide to purchase their own share from their existing shareholders either through a tender offer or through an open market. In such a situation, the price of concerning shares is higher than the prevailing market price.

What Is A Stock Buyback? - Forbes Advisor A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn't need to fund operations...

Share Repurchase - Overview, Impact, and Signaling Effect When a company buys back shares, it may be an indication that the company is facing very positive prospects that will place upward pressure on the stock price. Examples may be the acquisition of another strategically important company, the release of a new product line, a divestiture of a low-performing business unit, etc.

How Stock Buybacks Work and Why Companies Do Them - SmartAsset Reducing cash outflows and countering a potential undervaluing of shares are potential reasons. A stock buyback can mean many different things for investors. Make sure to examine the situation carefully and potentially. Also consider consulting with your financial advisor if a company you own stock in does a buyback. Tips for Stock Investing

Bank share buybacks: What they mean for you The buyback price will comprise two components - a capital component of $21.66 and a fully franked dividend, which will be the difference between $21.66 and the final sale price, minus the tender discount.

What is a share buy-back and how does it work? A share buy-back is a capital management strategy used by companies to return money to shareholders. In Australia, a share buy-back occurs when a company decides to repurchase shares from shareholders. These shares are then cancelled, reducing the number of shares on issue.

What is a share buyback? | Share repurchase definition | IG SG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future.

60 second guide: Share buybacks - CommBank Share buyback explained A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue.

buyback: Share Buyback: What it means for retail investors ... The company announces a share buyback worth a specified amount and at a price per share indicating the number of shares it wishes to purchase back from shareholders. For example, Wipro announced a Rs 11,000 crore buyback offer at Rs 320 per share to purchase 34.37 crore shares held by the shareholders. Buyback amount set aside for retail investors.

Share buyback - what this is and what a company needs to do A buyback of shares is where the company buys some of its own shares from existing shareholders. There are three types of share buyback: Purchase of own shares. Share redemption. Share capital reduction by: cancelling shares. repaying share capital. reducing the nominal value of a share class.

What is a Share Buyback? | Purpose, Example, Analysis ... Share buyback is an alternative means to compensate shareholders as opposed to dividends. When a company buys its shares, the number of outstanding shares in the market is reduced, hence the stake of the shareholders in the company is increased.

What does TCS' buyback mean for its stock A buyback may lead to some earnings dilution but considering the size of TCS, this is too small to provide any significant upside trigger to the stock," said an analyst with a domestic brokerage ...

Alibaba stock spikes after it ups share buyback program to ... Alibaba said on Tuesday it will increase the size of its share buyback program from $15 billion to $25 billion, effective for a two-year period through March 2024. The Chinese e-commerce giant's ...

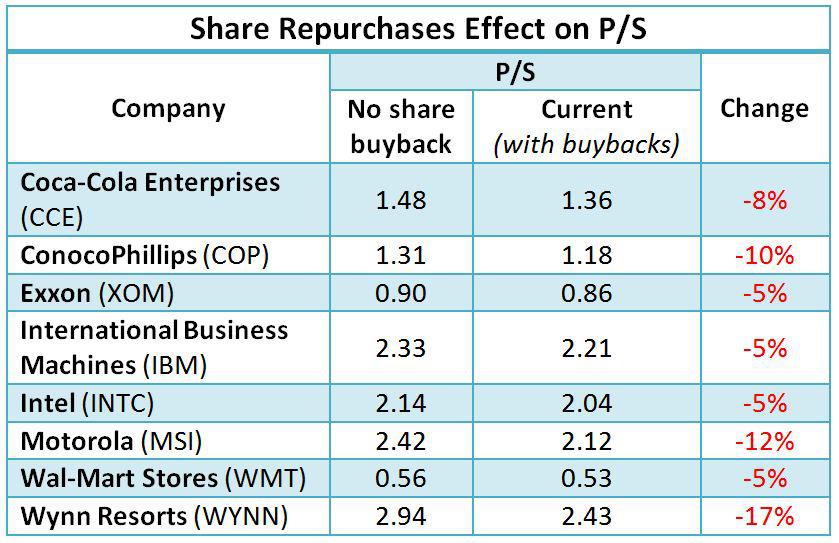

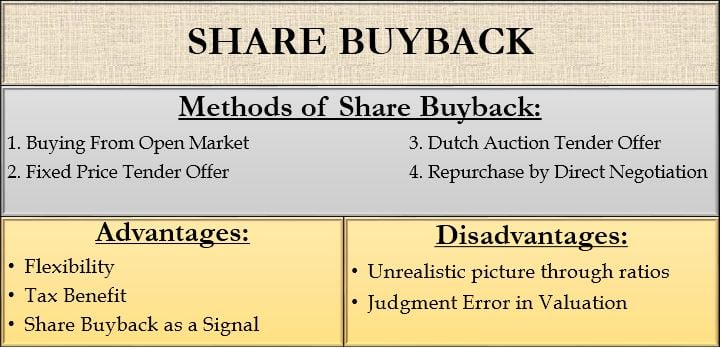

Share Buyback - Advantages, Disadvantages, and How Does It ... Share buyback The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder's approval is required for the successful execution of the transaction.

/why-would-company-buyback-its-own-shares_FINAL-dc32eefe564647ce9c66c345230fd0a9.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-907066380-0867bbed74914d3eab8d7d0c318a7577.jpg)

:max_bytes(150000):strip_icc()/why-would-company-buyback-its-own-shares_FINAL-dc32eefe564647ce9c66c345230fd0a9.png)

/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

0 Response to "41 what does share buyback mean"

Post a Comment