43 central bank digital currency

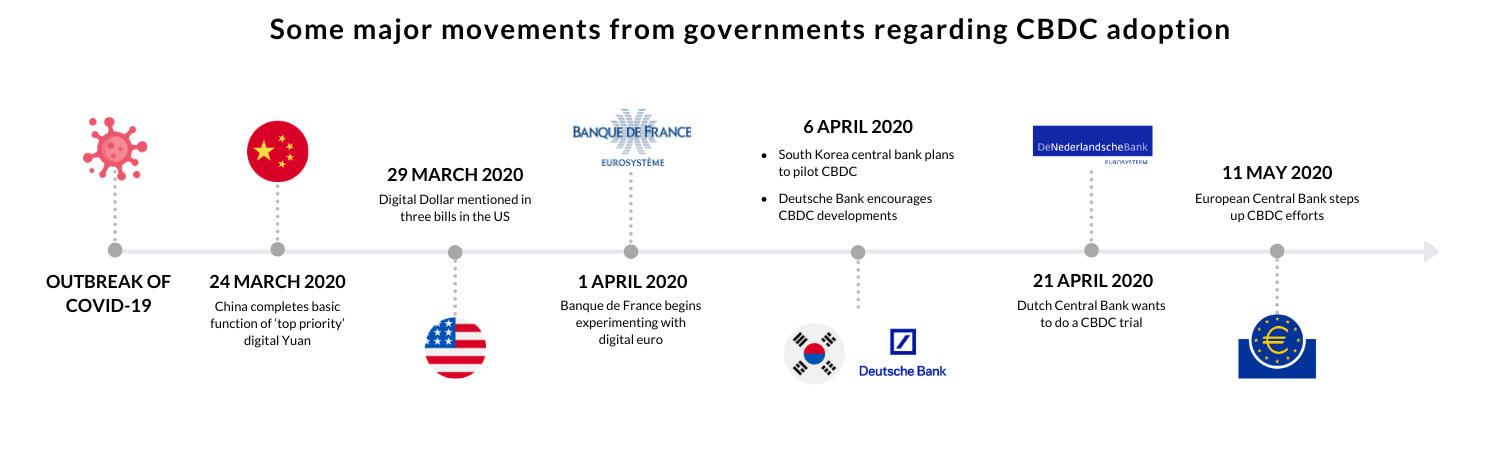

Why is the European central bank eyeing a 'digital euro ... BERLIN: The European Central Bank (ECB) on Monday will launch a public consultation and start experiments to help it decide whether to create a "digital euro" for the 19-nation currency club. The move comes as the pandemic accelerates a shift away from cash, and as policymakers nervously eye the rise of private cryptocurrencies like Bitcoin. Fed Paper on US Central Bank Digital Currency (CBDC) The Fed has released a discussion paper about a potential U.S. central bank digital currency (CBDC). The paper highlights five potential benefits and five key risks that a CBDC would create. It...

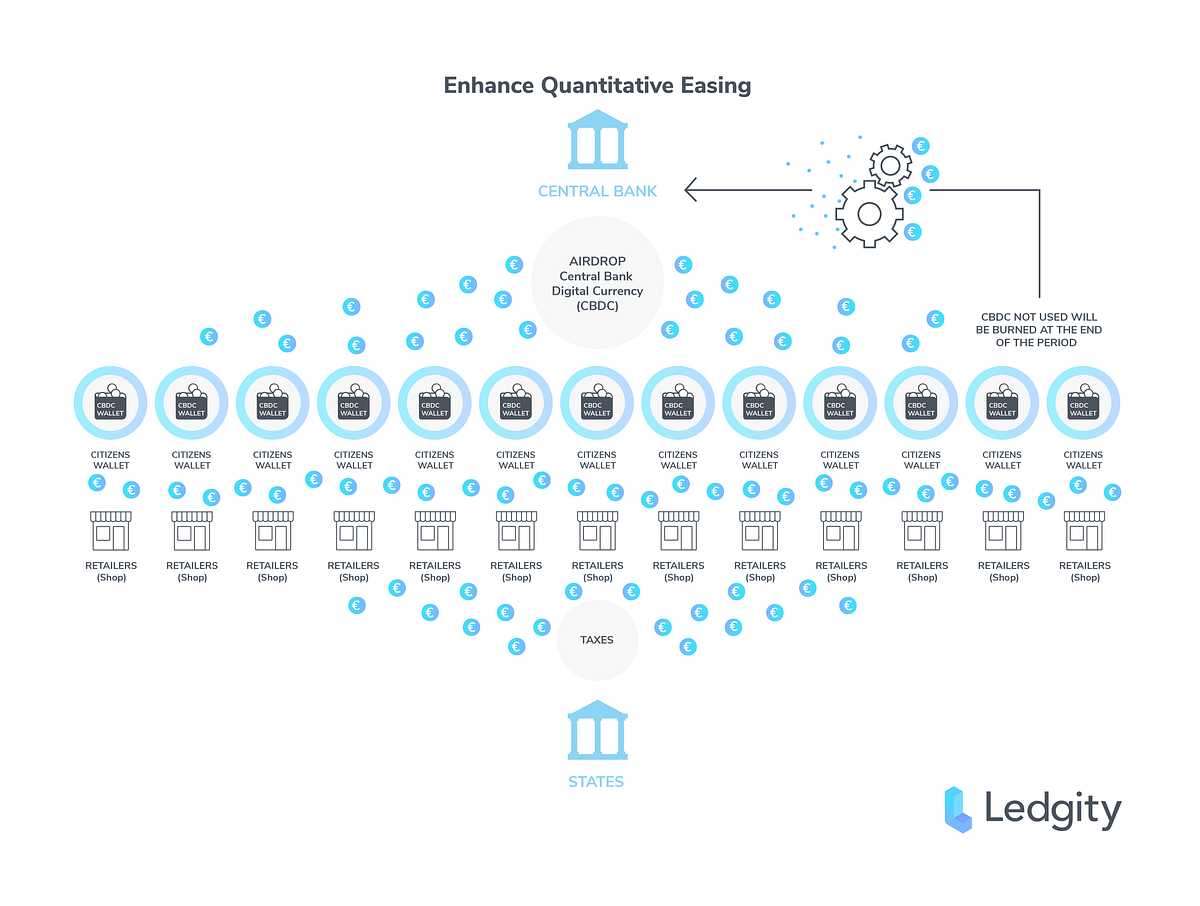

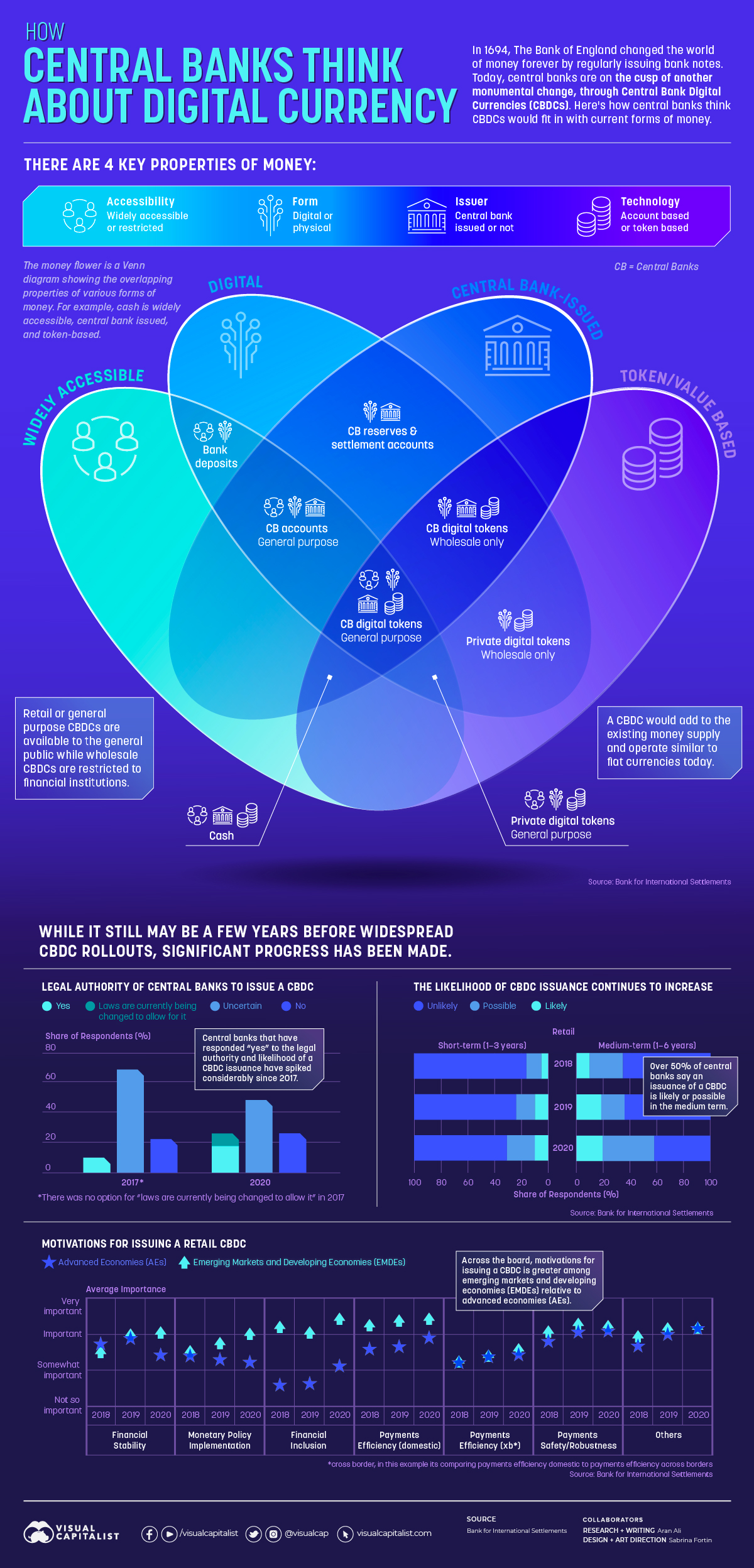

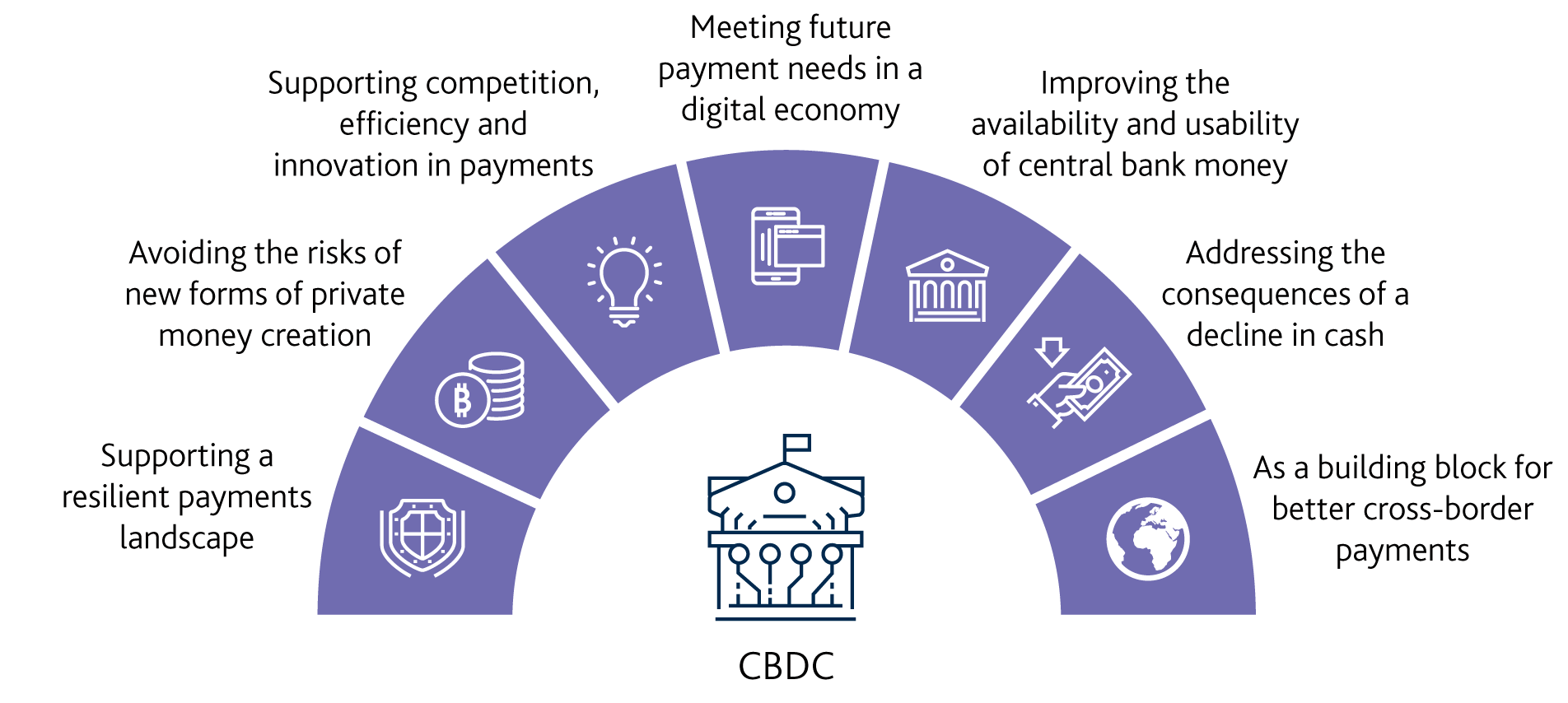

PDF Central bank digital currencies - Bank for International ... bank digital currency (CBDC). This consolidated report is an early contribution to this topic, providing a conceptual analysis of the potential effect of CBDC in three core central banking areas: payments, monetary policy implementation

Central bank digital currency

Digital Currencies and Fintech - Bank of Canada Canadian universities propose designs for a central bank digital currency The Bank of Canada is researching potential system designs and business models for a digital currency that, like a banknote, would be widely accessible, secure and denominated in Canadian dollars. India's Finance Minister Nirmala Sitharaman says she ... The Finance Bill of 2022 had also proposed that the Central Bank Digital Currency (CBDC) "should also be regarded as bank notes". The central bank has been working on a CBDC for the last two ... Opportunities and risks of central bank digital currencies ... To ensure acceptance and trust, a digital euro has to be made accessible to all population groups without barriers, but in a safe manner. Money laundering and terrorist financing have to be effectively prevented. As you can see, it is obvious that a central bank digital currency must be designed carefully.

Central bank digital currency. The Fed - What is a Central Bank Digital Currency? Central bank digital currency (CBDC) is a generic term for a third version of currency that could use an electronic record or digital token to represent the digital form of a nation's currency. CBDC is issued and managed directly by the central bank and could be used for a variety of purposes by individuals, businesses, and financial institutions. Behind the Scenes of Central Bank Digital Currency Central banks are increasingly pondering whether to issue their own digital currencies to the general public, so-called retail central bank digital currency (CBDC). The majority of IMF member countries are actively evaluating CBDCs, with only a few having issued CBDCs or undertaken extensive pilots or tests. We see clear advantages in central bank driven digital ... Union Finance Minister Nirmala Sitharaman on Tuesday said the 'Digital Rupee' is a conscious call taken in consultation with the Reserve Bank of India and the government sees clear advantages in a central bank driven digital currency.The Minister was speaking at the India Global Forum's annual summit here. "It was a conscious call taken in consultation with the central bank- the Reserve Bank ... Central bank digital currency is the next major financial ... Rather than be a tradable asset with wildly fluctuating prices and limited use, the central bank digital currency would function more like dollars and have widespread acceptance. It also would be...

Fed outlines pros and cons of a US 'digital dollar' -- but ... "Central bankers suddenly got blindsided; and so, a central bank digital currency is central bankers trying to hold on to their monopoly over currency issuance in the face of erosion of that ... USA CBDC - Central Bank Digital Currency Central Bank Digital Currencies (CBDC) are about to be deployed across the world's most powerful countries. China already has one, Russia is trialing one, and the United States will release news on the digital dollar soon. This marks the end of freedom as governments will be given surveillance powers like never before. We see clear advantages in a central bank driven digital ... "It was a conscious call taken in consultation with the central bank- the Reserve Bank of India….we would like them to design it the way they would like to do it, but this year we expect the currency to come out from the central bank itself," Sitharaman said in response to a question on Digital Rupee. Central bank digital currencies | Bank of England A Central Bank Digital Currency (CBDC) would allow households and businesses to directly make electronic payments using money issued by the Bank of England. We have not yet made a decision on whether to introduce CBDC. The Bank provides physical money in the form of banknotes, which can be used by households and businesses to make payments.

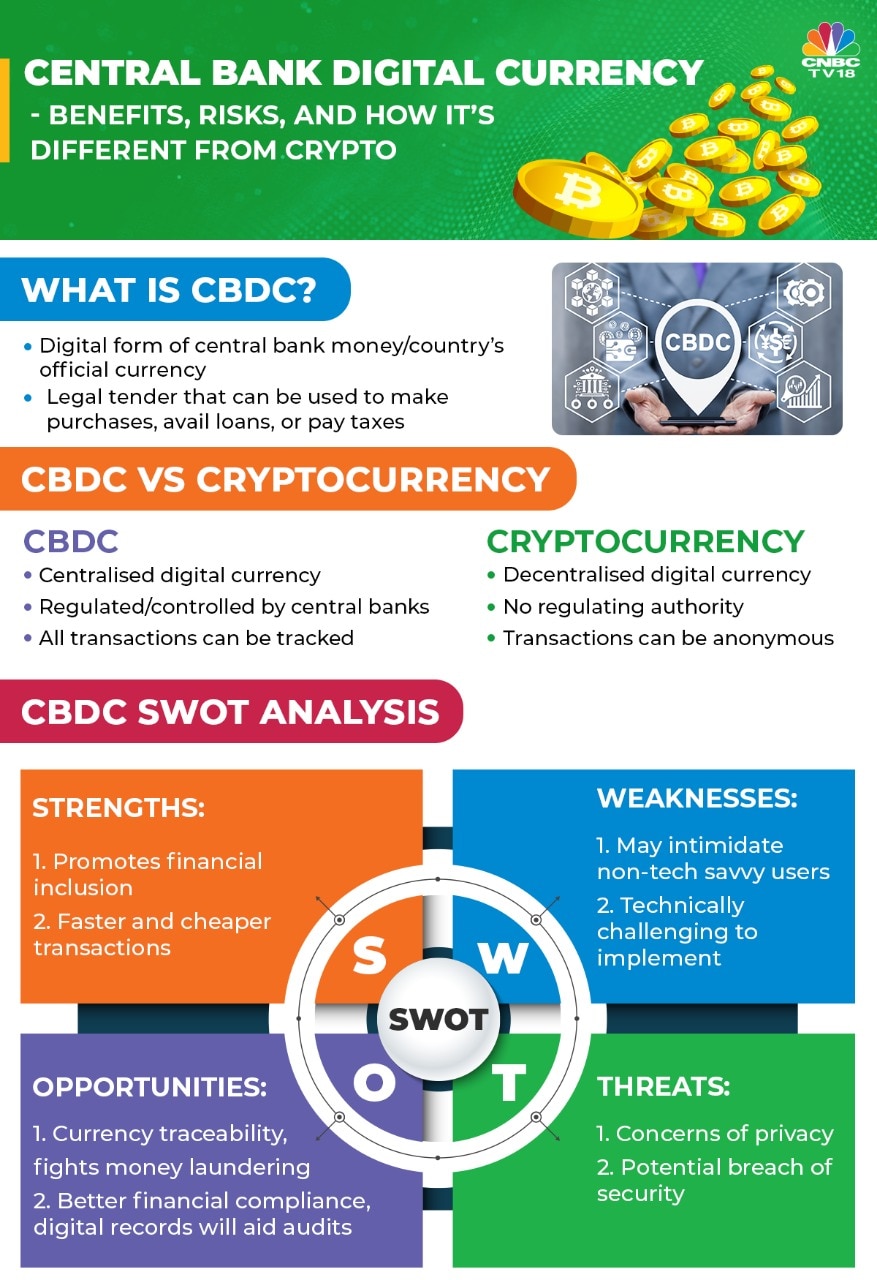

Advantages of Central Bank Digital Currencies (CBDCs ... Central bank digital currency (CBDC) is one of the most common topics of discussion nowadays among central banks all over the world. The advantages of central bank digital currency are essential examples of the use of innovative technologies for creating a new form of money. Central Bank Digital Currency (CBDC) - Overview, Types ... Central Bank Digital Currency (CBDC) is a form of fiat currency issued by the central banks of various countries. A fiat currency is considered any form of currency that is not backed by an underlying physical commodity. CBDC is issued by central banks in token form or with an electronic record associated with the currency. Federal Reserve Board - Central Bank Digital Currency (CBDC) Jan 20, 2022 · CBDC is generally defined as a digital liability of a central bank that is widely available to the general public. Today in the United States, Federal Reserve notes (i.e., physical currency) are the only type of central bank money available to the general public. Like existing forms of money, a CBDC would enable the general public to make ... The Fed - Central Bank Digital Currency: A Literature Review The first strand of the literature asks how CBDC will affect commercial banks. Fundamentally, CBDC can serve as an interest-bearing substitute to commercial bank deposits. Faced with such a substitute, commercial banks may respond by changing the deposit rates they offer to savers and, because of the resulting impact on banks' funding cost, the terms of the loans they offer to borrowers. As a result, both the quantity of bank deposits and the volume of bank-intermediated lending may change with the introduction of a CBDC. In this respect, this strand of the literature can speak to the concern of some policymakers that the introduction of CBDC may replace banks' main source of funding and cause disintermediation of commercial banks, which in turn may lead to a decrease in their lending. Andolfatto (2018) studies these effects on a monopoly bank. In his paper, when the CBDC is interest-bearing, the bank, which makes positive profits in equilibrium, raises the equilibrium deposit rate...

What If Central Banks Issued Digital Currency? He argues that a switch to Central Bank Digital Currency (CBDC) would be safer for depositors (because CBDC is a direct liability of the issuing central bank, not of a commercial bank), would ...

Central bank digital currency - Wikipedia A central bank digital currency ( CBDC) (also called digital fiat currency or digital base money) is a digital currency issued by a central bank, rather than by a commercial bank . A report by the Bank for International Settlements states that, although the term "central bank digital currency" is not well-defined, "it is envisioned by most to ...

Central Bank Digital Currency (CBDC) Definition Feb 09, 2022 · A central bank digital currency is the digital form of a country's fiat currency. A CBDC is issued and regulated by a nation's monetary authority or central bank. CBDCs promote financial inclusion ...

CBDC | Central Bank Digital Currency — MIT Digital ... Many central banks are exploring the creation of a central bank digital currency (CBDC), a new form of central bank money which could be made available to the general public. Central banks, researchers, and policymakers have proposed various objectives including fostering financial inclusion, improving efficiency in payments, prompting ...

Central bank digital currencies - the future of money ... However, central bank digital currency would be a third form of central bank money, alongside cash and bank reserves. Introducing a new form of central bank money such as this could have profound impact on the financial system, especially if it is not only available to banks, but instead, like cash today, to the general public.

U.S. Digital Dollar News: Is America Moving to Virtual ... According to this paper, the Fed is looking to introduce a U.S. digital dollar called the central bank digital currency (CBDC).This would allow citizens to download and use an app for payments.

Central Bank Digital Currency Introduction by RBI in India ... Central Bank Digital Currency (CBDC) is increasingly being referred to as the 'future of money,' which is also evident from the fact that 87 countries representing 90% of the global GDP are currently exploring digital currencies. China was the first major economy to create its own digital currency in April 2021 and the Chinese Central Bank has recently launched digital Yuan wallets for ...

Opinion: Central bank digital currencies are coming. The ... Aug 13, 2021 · Cryptocurrencies, like bitcoin and dogecoin, have dominated the news cycle in recent months. Meanwhile, the rise of another type of digital currency has gotten far less attention: central bank ...

PDF Central Bank Digital Currency value are pegged to an underlying national currency issued by a central bank. These innovations are forcing us to revisit the very definition of money and currency as an exchange of value, terms we had for decades taken for granted. A few central banks are considering or beginning the process of issuing a central bank digital currency (CBDC).

Central bank digital currency (CBDC) - INSIGHTSIAS What is the CBDC or National Digital currency? A Central Bank Digital Currency (CBDC), or national digital currency, is simply the digital form of a country's fiat currency. Instead of printing paper currency or minting coins, the central bank issues electronic tokens. This token value is backed by the full faith and credit of the government.

Opportunities and risks of central bank digital currencies ... To ensure acceptance and trust, a digital euro has to be made accessible to all population groups without barriers, but in a safe manner. Money laundering and terrorist financing have to be effectively prevented. As you can see, it is obvious that a central bank digital currency must be designed carefully.

India's Finance Minister Nirmala Sitharaman says she ... The Finance Bill of 2022 had also proposed that the Central Bank Digital Currency (CBDC) "should also be regarded as bank notes". The central bank has been working on a CBDC for the last two ...

Digital Currencies and Fintech - Bank of Canada Canadian universities propose designs for a central bank digital currency The Bank of Canada is researching potential system designs and business models for a digital currency that, like a banknote, would be widely accessible, secure and denominated in Canadian dollars.

![7 Central Bank Digital Currency [18]] | Download Scientific ...](https://www.researchgate.net/profile/Mamta-Mittal/publication/353296388/figure/fig2/AS:1056286795890698@1628849805485/Central-Bank-Digital-Currency-18.png)

0 Response to "43 central bank digital currency"

Post a Comment